The European single currency struggled to gain terrain last week in front of the US dollar. It managed to hit the high of the week on Tuesday, when the Industrial Production for the Euro Area was posted 1.8%, 0.2% above analysts’ estimation. It was actually the only economic data posted above the forecasts. The rest of the releases were in line or under the forecasts. The CPI was 0.8%, in line with the estimates, but well under the ECB’s target of 2%. The Core CPI rose with only 0.7%. These will, for sure, put pressure on the ECB.

The US dollar was aggressively bought on Friday even though the economic data released for the United States was under estimates. The EUR/USD currency lost almost 1.0% and confirmed the downtrend on the short term time interval. Continue reading this article to see what are the economic expectations for this week and what does the technical analysis says for the short and medium term.

Latest EURUSD posts on Fundamental Analysis:

15 January Wrap Up – Why Did The Market Rally?

EUR/USD – 14 January Morning Overview

Economic Calendar

German PPI – Monday (7:00 GMT). Although expected to rise with 0.1% in November, the actual post was a drop of 0.2%. In December it wasn’t expected any change, but it actually dropped with 0.1%. This month the German Producer Price Index is expected to rise with 0.2%. Another disappointing release might discourage investors in buying the Euro.

German Buba Monthly Report – Monday (11:00 GMT). It would be very interesting to read especially if the report reveals viewpoints which crash with the ECB’s stance.

German Constitutional Court Ruling – Tuesday (doesn’t have a specific hour). The German Federal Constitutional Court is due to announce a ruling regarding the constitutionality of the ECB’s Outright Monetary Transactions policy (OMT), in Karlsruhe.

German ZEW Economic Sentiment – Tuesday (10:00 GMT). From August 2013 the German Zew has surprised the market with better than expected releases. In November the actual was in line with the 54.6 estimates. This even did not repeat itself in December when the actual release was of 62.0, with 4.7 points above the analysts’ forecast. On Tuesday it is expected to be around 63.4. If the actual release will be in line or above this forecast, the Euro might get some fundamental support. On the other hand, a drop in this indicator could mean another hit for the Euro Area, especially for Germany.

ZEW Economic Sentiment – Tuesday (10:00 GMT). The Euro Area ZEW didn’t have a smooth road like the German ZEW. In October the indicator was in line with the estimates, disappointed in November, but In December was with 7.4 points above the forecast. This month is estimated to rise at 70.2

Flash Manufacturing PMI – On Thursday at 08:00 GMT will be published the French PMI. From August last year each release was under the analysts’ estimates. December’s release was of 47.1, which was under the 49.1 estimated, revised this month to 47.0. This month it is expected to be 47.6, but it will not be any surprise for us if it will disappoint again. At 08.30 GMT the German Flash Manufacturing will be released. After it had October and November in line with the estimates, last month surprised with a 1.1 points higher value, at 54.2. For this week it is expected to be somewhere around 54.7. The Euro Area Flash Manufacturing it is expected to be published at 09:00 GMT. This one had a similar evolution like the German one. It was in line with the forecasts in October and November and exceeded them in December. This month it is expected around 53.2.

Flash Services PMIs – They are noted to have a less impact on the market, but if the differences between the forecasts and the actual releases are big, then they could raise the volatility of the EURUSD pretty fast. The French Services PMI is expected to be released Thursday at 08:00 GMT around the 48.2 value. The German Services PMI was lower than estimates in December, with a 54.0 release. This month was revised at 53.5 and the forecast is of 54.1. The Euro Area Services PMI is programmed at 09:00 and is expected to be around 51.5.

Current Account – Thursday (09:00 GMT). The Euro Area Current Account it is expected to be this month around 19.2B after in December was recorded a value of 21.8B.

These are the most important releases for the Euro Zone next month. We would like to highlight the German ZEW Economic Sentiment and the Flash PMIs to be more important. But as we look at the EURUSD pair and not the Euro alone, we should see what economic releases are scheduled for the United States.

On Monday it will be a Bank Holiday for the United States, on Tuesday, Wednesday and Friday it seems that nothing important is scheduled. Thursday will be the most crowded day as for the Economic releases for the United States and the USD: Unemployment Claims – Exp. 331K; Flash Manufacturing PMI – Exp. 55.2; HPI – Exp. 0.4%; Existing Home Sales – Exp. 4.99M.

Technical View

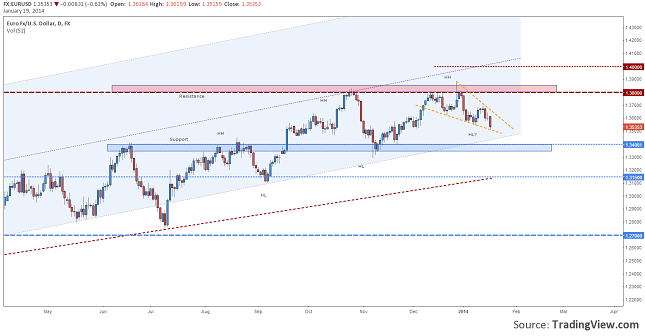

EURUSD, Daily

Support: 1.3400, 1.3150;

Resistance: 13800, 1.4000;

The price has continued the down move after the Euro tried to comeback in the beginning of this week. The pressure coming from the US buyers was too big to handle. EURUSD dropped around 1% and seem to have drawn a Falling Wedge. This pattern in the current conditions is bullish as long as the lower line will not be broken in the upcoming week. Of course traders will also need a strong bullish confirmation to get in long positions.

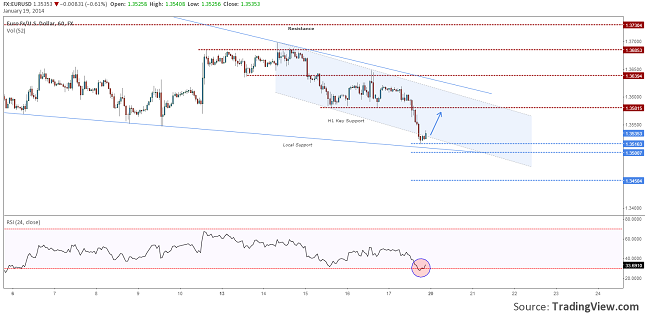

EURUSD, H1

Support: 1.3515, 1.3500, 1.3450;

Resistance: 1.3580, 1.3640.

On the lower, H1, time frame we can see that the rally of the US dollar from Friday triggered a bullish signal. The 24 periods RSI went in the oversold area and came back after the price has broken the rejection line of the down trend channel. In this case we could expect a retrace back in the 1.3560/80 area. If the price will break 1.3500 this week then we can expect for the downtrend to continue to 1.3450 or why not, even lower.

Latest EURUSD posts on Technical Analysis:

EURUSD – Short Term Rectangle Pattern

Bullish or Bearish

My stance would be bullish for the US dollar on the medium term. Even though there will be more economic releases for the Euro Area this week, the tendency could remain bearish. As long as no clear bearish signals will appear it would be pretty hard to change this view.

EUR/USD Forecast January 20-24 by Razvan Mihai