The Euro Area single currency managed to close the week on a positive territory in front of the US dollar. The way there wasn’t that easy, but actually quite bumpy. On Wednesday Euro plunged after an official of the ECB brought back on the table the possibility of getting to negative interest rates. After hitting a low at 1.3565, investors’ enthusiasm brought it back above 1.36 on Thursday, helped also by the low retails sales from the US. On Friday the price of EUR/USD got higher thanks to some very good GDPs published for France, Germany and the entire Euro Area.

Next week the main publishes will be the German ZEW economic sentiment, Flash Manufacturing PMIs for the Euro Area and the Core CPI for United States of America. Continue reading this article to see what will be the most important economic indicators released for US and Euro Zone and what are our technical perspective for the most traded currency pair, EURUSD.

Economic Calendar

Tuesday

EUR: Current Account (09:00 GMT). This month current account released for the Euro Area is expected to be around 19.8B. In the last month of 2013 its release was of 21.8 above analysts forecast, same was in January 2014.

EUR: German ZEW Economic Sentiment (10:00 GMT). The ZEW Economic Sentiment is one of the most important leading indicators for Germany. In January was published 61.7, bellow its forecast. This month it is expected to be around 61.7. If the release will come as a surprise it might influence the evolution of EURUSD on the short term.

EUR: ZEW Economic Sentiment (10:00 GMT). The same type of indicator is also published for the entire Euro Area at the same hour, but it is considered to have a lower indicator than the one for Germany. The last two releases were above expectations and for this month the markets are waiting for it to be around 73.9.

USD: TIC Long-Term Purchases (14:00 GMT). The most important indicator released for US on Tuesday is the TIC. It had an ugly fall in January to -29.3, even though the analysts forecasted it around 42.3. For February is expected to remain on negative ground, around -24.7B.

Wednesday

USD: Building Permits (13:30 GMT). Wednesday will be the day for the US releases. First of them are the building permits. Analysts managed to correctly forecast its last two releases. In December was 1.01M, while on the first month of 2014 was 0.99M. In February is expected around 0.99M.

USD: PPI m/m (13:30 GMT). At the same hour the producer price index is to be released for the US. In January was at 0.4% and now it is expected to get to 0.6%. I don’t believe investors are thinking of a higher PPI, so a lower one will not be a surprise.

USD: FOMC Meeting Minutes (19:00 GMT). The detail report of the FOMC’s most recent meeting is scheduled for this week. If there are details unexpected and untold at the last meeting, we might witness some high volatility.

Thursday

EUR: German PPI (07:00 GMT). The German producer price index is expected to gain 0.3% after it raise 0.1% in January and dropped 0.1% in the last month of December.

EUR: French Flash Manufacturing PMI (08:00 GMT). 2014 started with the right leg for the French manufacturing sector. The flash PMI published for last month surprised with a 48.8 reading, above analysts’ expectations but still under the 50.0 level. This month it is expected to get 49.6. If it will be published above this level, we might see some rallies for the Euro.

EUR: French Services PMI (08:00 GMT). Less important than the manufacturing, but still a medium impact indicator, the services flash PMI for France is expected to hit 49.5 this month.

EUR: German Flash Manufacturing PMI (08:30 GMT). This is consider to be another important leading indicator for the German economy. From October 2013 it didn’t disappoint the market with a reading below analysts’ forecast. This month it is expected to rise above last month, at 56.4. Its publication usually trigger higher volatility.

EUR: German Flash Services PMI (08:30 GMT). Scheduled at the same hour, the services flash PMI for Germany it is expected to be above last month release, at 53.4.

EUR: Flash Manufacturing/Services PMI (09:00 GMT). For the Euro Area it is expected a flash manufacturing PMI at 54.2 and a services flash PMI of 51.9.

USD: Core CPI m/m (13:30). Everyone has their eyes on the consumer price index for the United States. In January it gained only 0.1% and the same value is expected also for this month. It is an important indicator for the economy, because there are motives to believe that it might rally in the future.

USD: Philly Fed Manufacturing Index (15:00 GMT). This is one of the most important indicators for the US manufacturing index. It usually triggers volatility especially when it is releases as a surprise. In December it went all the way to 9.4 points and this month it is expected to remain in this area, around 9.2 points.

USD: Fed Chairman Yellen Testifies. On Thursday Janet Yellen is due to testify on the Semiannual Monetary Policy Report before the Senate Banking Committee, in Washington DC.

Friday

EUR: EU Economic Forecasts (10:00 GMT). This report includes economic forecasts for EU member states over the next 2 years, and covers about 180 variables. Source changed release frequency from twice per year to three times per year as of Feb 2012.

USD: Existing Home Sales (15:00 GMT). This is an important indicator for the US real estate sector. For the past two months it has been released under analysts’ forecasts. For next week it is expected to be around 4.73M.

Next week will be full of scheduled economic releases. Even though on Monday it will be quite relaxing with the USA bank holiday, from Tuesday the party will begin. We have brought up the most important releases which could not only trigger high volatility for EURUSD, but also change its short term direction.

Technical View

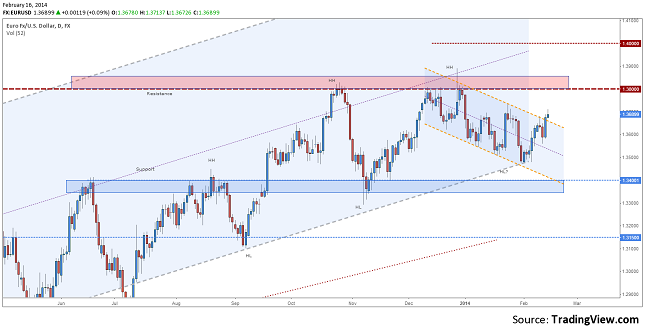

EURUSD, Daily

Support: 1.3400, 1.3550;

Resistance: 1.3700, 1.3800;

The price of the Euro continued to gain in front of the US dollar for a second week in a row. On a daily chart we can see that the upside line of the down channel was broken and the breakout was confirmed. This could mean that the price might continue it’s up move to 1.3800. On the longer time frame the price is still bubbling between 1.3400 and 1.3800. I don’t believe that without a strong reason the price will break this range next week.

EURUSD, H1

Support: 1.3683, 1.3600, 1.3682;

Resistance: 1.3712, 1.3730, 1.3800;

From the Wednesday dip the trend was up and quite smooth with no big corrections. On Friday it consolidated itself just under the 1.3712 resistance and 1.3682 support. I believe that a fall under the local support could send the price lower to retest the 1.3650 support. On the other hand a rally above the 1.3712/30 area could mean that investors are willing to get the euro higher, targeting the 1.3800 resistance.

Bullish or Bearish

On a lower time frame I believe that Euro will force its way higher and touch 1.3800 next week. This if there will be no strong negative surprises from the scheduled economic releases. On the medium term, as I said for the Daily Technical Analysis, I am not expecting a breakout from the 1.34/1.38 range, holding my range position.

EUR/USD Forecast February 17 – 21 by Razvan Mihai