Euro managed to close the 4th week on positive ground. Even though last week didn’t start very good because of the low German economic data things have changed in the second half. The 0.8% inflation has risen investor’s optimism and that was seen also on the EURUSD chart. The Euro has passed again above 1.38 key level. Even though it didn’t close the day and week above this level it still a big step for the European single currency.

Next week’s economic calendar is full with important releases and events. Continue reading our article to see what the most expected indicators are and what technical analysis suggests.

Economic Calendar

Monday:

Spanish Manufacturing PMI (08:15 GMT) – This economic indicator for the Spanish Manufacturing sector has surprised the market with the first two releases of this year, above expectations. In February it was published 52.2 and it is expected for Monday to be even higher at 53.2.

Italian Manufacturing PMI (08:45 GMT) – 30 minutes after the Spanish PMI it is expected to be released the Italian one. Italy had a very good January release but it didn’t keep the same line for February. Last month the Manufacturing PMI was released 53.1, which was 1.1 points under estimates. This month the expectations are lowered to 53.3.

ECB President Draghi Speaks (14:00 GMT) – He is due to testify before the Committee on Economic and Monetary Affairs of the European Parliament, in Brussels.

ISM Manufacturing PMI (15:00 GMT) – This is one of the top leading indicators from USA. In January its release didn’t brought any surprise. In February it was almost 5 points lower than its estimates. For Monday the expectations are lowered from 56.2 all the way to 52.3. It usually triggers volatility in the market, especially when it comes as a surprise.

Tuesday:

[sociallocker]

Spanish Unemployment Change (08:00 GMT) – It is considered to be a medium impact indicator for the FX market. It usually triggers high volatility if the difference between the actual and the estimated values is very big. Especially because it is a very volatile indicator itself. For this month it is expected to be around 74.2K.

Wednesday:

Spanish Services PMI (08:15 GMT) – Another important sector in an evolved economy is Services. From November 2013 to January 2014 this indicator was published above expectations. Last month it disappointed the market with a 54.9 release. For Tuesday it is expected to be 55.3.

Italian Services PMI (08:45 GMT) – In February the Italian Services PMI was published 49.4. Above expectations but still was under the 50 level, which is not very good for the economy. For this month it is expected to get at 50.6 which would be good news for Spanish services sector.

Retail Sales (10:00 GMT) – The Euro Area Retail Sales will be released on Wednesday and they are expected to rise with 0.9%. In February they fell 1.6% after in January they have surprised the market with a 1.4% rise.

ADP Non-Farm Employment Change (13:15 GMT) – An important indicator for the US labor market. It is released before the NFP and it is closely watched by the market. It usually triggers high volatility for the EURUSD, especially if the surprise is big. For this month it is expected to be only 159K after in February it was 175K and in January 238K.

ISM Non-Manufacturing PMI (15:00 GMT) – This is an important indicator for the Non-Manufacturing sector in the USA. It was released at 54.0 last month, but the expectations seem to be lowered to 53.8 for the upcoming week.

Thursday:

German Factory Orders (11:00 GMT) – After a rise of 2.1% in January, the German factory orders managed to disappoint in February, when it was released -0.5%. For this month the expectations are pretty high comparing with last month, 1.1% growth.

Minimum Bid Rate (12:45 GMT) – It is expected to remain 0.25% for a long period of time. After last week’s inflation report I believe that it is a high probability for it to remain at the same level.

ECB Press Conference (13:30 GMT) – One of the most important events that are held during a month. It usually triggers high volatility especially if the ECB president, Mario Draghi, has an objective/subjective position regarding the Euro Area economy.

Unemployment Claims (13:30 GMT) – It is released weekly, but considered a high impact indicator for the EURUSD. This week it is expected to be 336K, lower than its previous reading.

US Factory Orders (15:00 GMT) – In 2014 the first 2 releases were in line and better than analysts have estimated. For March the expectations are of -0.4%.

Friday:

German Industrial Production (11:00 GMT) – It is expected to be around 0.7% growth after in February it dropped with 0.6%.

Non-Farm Employment Change (13:30 GMT) – This indicator it is also known as the NFP and it is the most important release for the US labor market. It is closely watched by Fed as a landmark for the QE trimming. It is expected to be 151K after last month’s reading was of 113K.

Trade Balance (13:30 GMT) – Even though it is considered to be a high impact indicator, it is usually volatile enough to not surprise the market to much. For this month it is expected to fell at -39.1B.

US Unemployment Rate (13:30 GMT) – After the big fall from 7.0 to 6.7% in January, the Fed knew that it is time for them to start tapering. In February it fell even more to 6.6%, but for March it is expected to stay still at this level.

As you can see it will be a week full of important events. The highlights are the US Manufacturing and Non-Manufacturing PMIs, the Euro Area Minimum Bid Rate and the ECB Press Conference and the USA labor market data. As a trader I would recommend you to keep your eyes on this events because they will trigger high volatility which might catch you with the wrong foot in the market.

Technical View

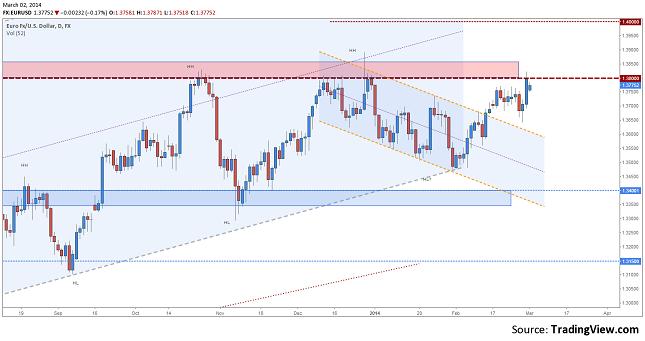

EURUSD, Daily

Support: 1.3650, 13400

Resistance: 1.3800, 1.4000;

On the daily chart we can see that after the breakout from the down channel, EURUSD got back and retested the trend line around 1.3650. The last two days of last week got the Euro all the way to 1.3800. This week’s opening was with a negative gap, which was almost closed by the price. The tendency seems to be up and buyers will do all that it is needed to break 1.3800. A daily close above 1.3850 could be the positive signal that will offer a better confirmation for another rally.

EURUSD, H1

Support: 1.3751, 1.3700, 1.3681;

Resistance: 1.3800, 1.3822, 1.3875;

On a lower time frame we can see better the negative gap. The price hit the 1.3800/22 resistance area and was clearly rejected from there. At this point a drop under 1.3751 could trigger a drop back to 1.3700. On the other hand a breakout above 1.3822 could trigger another rally that would target 1.3875.

Bullish or Bearish

At this point, considering the latest price action, but also the good inflation reading, I would say that Draghi might have a speech that could make investors buy even more the Euro and send it above the resistance. Keep a bullish outlook for the Euro, with my eyes open at the ECB monetary statement and press conference, as well as at the NFP publishing.

[/sociallocker]

EUR/USD Forecast March 3-7 by Razvan Mihai