|

EUR |

German PPI m/m |

-0.2% |

-0.1% |

-0.2% |

|

EUR |

Current Account |

25.9B |

14.2B |

14.6B |

|

EUR |

German 10-y Bond Auction |

1.41|1.6 |

1.28|1.6 |

|

|

USD |

Existing Home Sales |

4.97M |

4.99M |

4.94M |

|

USD |

Fed Chairman Bernanke Testifies | |||

|

USD |

Crude Oil Inventories |

-0.3M |

-0.4M |

-0.6M |

|

EUR |

French Flash Manufacturing PMI |

45.5 |

44.8 |

44.4 |

|

EUR |

French Flash Services PMI |

44.3 |

44.7 |

44.3 |

|

EUR |

German Flash Manufacturing PMI |

49.0 |

48.6 |

48.1 |

|

EUR |

German Flash Services PMI |

49.8 |

50.2 |

49.6 |

|

EUR |

Flash Manufacturing PMI |

47.8 |

47.1 |

46.7 |

|

EUR |

Flash Services PMI |

47.5 |

47.4 |

47.0 |

|

USD |

Unemployment Claims |

340K |

347K |

363K |

|

USD |

Flash Manufacturing PMI |

51.9 |

51.6 |

52.1 |

|

USD |

New Home Sales |

454K |

429K |

444K |

|

EUR |

ECB President Draghi Speaks | |||

|

EUR |

GfK German Consumer Climate |

6.5 |

6.2 |

6.2 |

|

EUR |

German Ifo Business Climate |

105.7 |

104.6 |

104.4 |

|

USD |

Core Durable Goods Orders m/m |

1.3% |

0.6% |

-1.5% |

|

USD |

Durable Goods Orders m/m |

3.3% |

1.6% |

-6.9% |

A very interesting week just passed for both Euro Area and US economies.

The data published for Europe showed an improvement in the French and German Manufacturing PMI, also for the entire Euro Area, but lower PMIs for the Services Sector. Beside the 0.2% drop in the German PPI the rest of the indicators came above expectations. The Current Account was 25.9B, the Consumer Climate went up to 6.5 and the German Ifo Business Climate beat expectations.

Don’t think the US stood worse. Even though the Existing Home Sales was lower than the estimates, new home sales were above the previous numbers and also above expectations. The Manufacturing PMI was in line with the expected value and the Core Durable Goods Order rose 1.3%. Let’s not forget about Unemployment Claims, which has triggered high volatility during the last weeks, has come once again better than expected.

We can see that data are in an equilibrium, but the real action came after Ben Bernanke testified in front of the Economic Committee. He made it quite clear that for the moment they will not stop the quantitative easing program, but when the time will come they will be prepared and they already have a plan of stopping it.

After FED’s governor testimony, the ball was on Mario Draghi’s field. He did not say anything about lowering the interest rate more or even negative ones. He did not say anything about more easing, mainly nothing of what the markets were expecting from him. This helped the investor confidence to come back, at least for the moment.

Adding the fact that China reported a 49.6 Manufacturing PMI, to what Bernanke have said during the testimony, the markets reacted with fear. The US dollar, the Japanese yen and the Swiss franc have gained in front of the other currencies, but it did not take forever this appreciation because the optimism was quickly reinstalled.

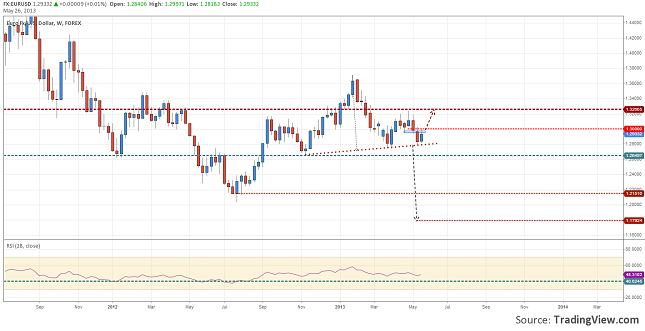

Chart: EURUSD, Weekly

If last week the probability for the EURUSD to drop under the H&S base line was high, not it has dropped. The 0.72% gain has drawn a Piercing Line pattern at the support area. We should look for more signals before considering one direction, especially on a short to medium term time frame. If it will have a daily close over 1.3000 then there is a big chance for it to target 1.31 or why not 1.32. On the other hand if it will drop under 1.27 it will look quite bad.

Wrap Up 20-24 May EURUSD Up 0.72% on Good Economic Data by Razvan Mihai