| Core Retail Sales m/m |

0.7% |

0.5% |

0.4% |

|

| Retail Sales m/m |

0.8% |

0.3% |

0.9% |

Last week’s news came as a positive surprise for the Canadian economy. Both retail sales and core retail sales were above expectations. After these publications BOC governor Carney was pretty confident in a recovery this year and said that they will keep the interest rate at 1%. The Canadian dollar has been bought mostly on Thursday when the unemployment claims came better than expected for USA and investors were looking to place their money in a riskier asset.

We are expecting the publication of the GDP in the first part of the week, the estimation remained unchanged, and the Trade Balance to rise at -0.7B in the second part.

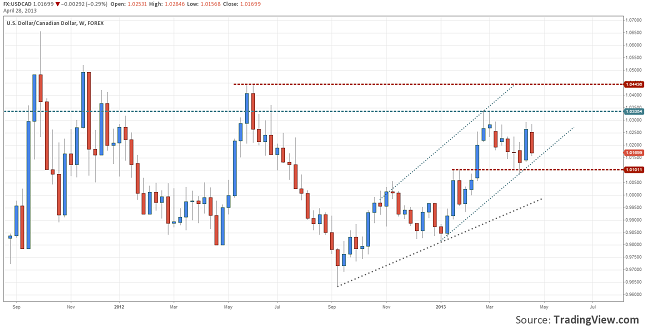

From the technical analysis we can see that USDCAD has consolidated between 1.029 and 1.0100. A break outside this area would tell us what it will be targeting, 1.0000 or 1.0500.

Wrap Up 22-26 April USDCAD Down 0.82% by Razvan Mihai