Great Britain

| Economic Indicator | Actual | Forecast | Previous |

| BBA Mortgage Approvals | 30.5k | 33.6k | 32.0k |

| CBI Realized Sales | 0 | 12 | 8 |

| Current Account | -14.0B | -12.8B | -15.1B |

| Final GDP q/q | -0.3% | -0.3% | -0.3% |

| Nationwide HPI m/m | 0.0% | 0.2% | 0.2% |

Last week was not a very goof week for UK’s economy. Final GBP remained unchanged at -0.3% and the Current Account was surprisingly published under market’s expectation. The pound was bought by investors on risk aversion, triggered by the Europe problems and the appreciation was seen mostly on EURGBP.

Next week the economic calendar for UK is full. On Tuesday Halifax HPI, Manufacturing PMI (expected 48.9 higher than previous) and Net Lending to Individuals will be published. Construction PMI is expected to rise at 47.7 on Wednesday and on Friday are scheduled Services PMI Asset Purchase Facility Official Bank Rate and MPC Rate Statement.

In our opinion this week’s macro indicators will make a difference and will point out the direction for the sterling pound. If the future economy outlook will be brighter than we can expect the pound to continue gaining.

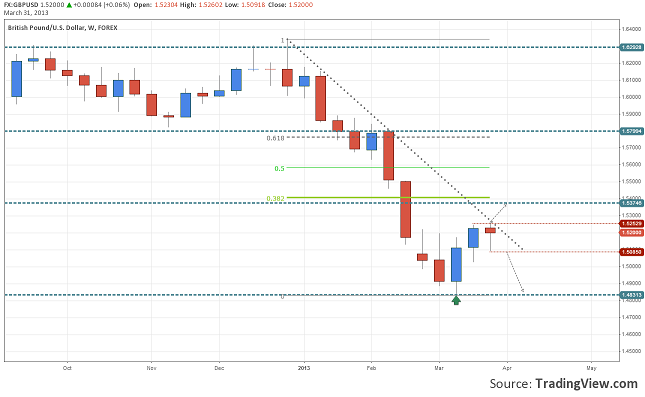

Looking at the technical analysis we will see a slight drop of 0.17% in GBPUSD. The two weeks rally stopped at 1.5250, right under the down trend’s line. If this area will be broke than we might see the pound continuing its rally to 1.5375 where the 38.2 Fibonacci retrace it is found. For the down side we should look for a weekly close under 1.51/1.5085.

Wrap Up 24-29 March GBPUSD Down 0.17% by Razvan Mihai