In mid-February the leading indicators (ZEW Economic Sentiment, Flash Manufacturing PMI and Ifo Business Climate) came in a positive direction, especially ZEW and IFO which have exceeded the expectations. In this situation we would have expected some good economic data releases for the next period.

Well it wasn’t quite like that, because the economic data posted for Germany was pretty low. After a final q/q GDP of -0.6%, as expected and final CPI m/m of 0.6%, as expected, only the retail sales came over the market estimates at a value of 3.1%. The rest of the macroeconomic indicators were lower than forecasts:

| Indicator | Actual | Forecast | Previous |

| Unemployment change | -3k | -5k | -14k |

| Industrial Production | 0.0% | 0.6% | 0.6% |

| Factory Orders | -1.9% | 0.6% | 1.1% |

| WPI m/m | 0.1% | 0.4% | 0.3% |

| Trade Balance | 15.7B | 17.9B | 16.9B |

This number cannot be a good signal for the future evolution of the economy. Next week will be published again the flash PMIs, ZEW and IFO Business Climate and it will be interesting to see the releases.

Another interesting point of view is related to the evolution of the 10 years bond, or known as German Bunds. At the last bond auction the yields were up 9 points at 1.66, meaning that the investors were interested more in risk assets, and the demand for the demand dropped for this fixed income instruments. If this will change next week and the yields will drop then we might see a risk aversion that will drag Germans shares lower.

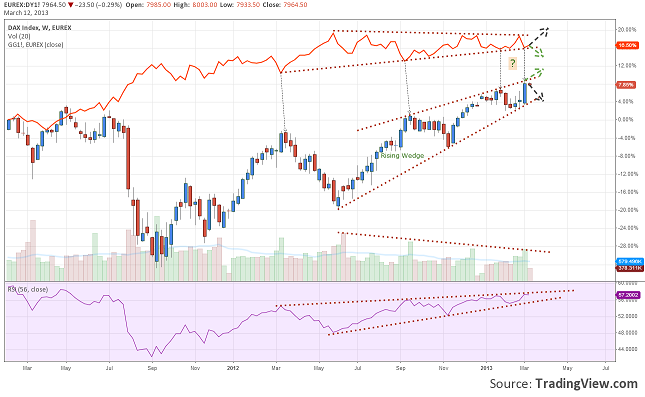

If we will take a look over the charts of DAX (German index) and Bund on a Weekly time frame, we will observe, that on the latest evolution, when an important low was drawn on the Bunds chart, an high was drawn on the DAX.

The signals at this moment are not bullish at all. On the main chart (stock average) the price has made a rising wedge and the same on the 56 RSI. Volume dropped during the uptrend. On the bonds chart the price moved in a symmetrical triangle consolidation.

Keeping in mind all the things mentioned earlier we can look for a signal from the evolution of the bunds to understand what might happen to the DAX. If the price will go up, making a new low or breaking the upper line of the triangle, then the investors might try to get back in safer assets and this might trigger falls on the stock exchange. On the other hand if the price will break the down line of the triangle then we might see an invalidated Rising Wedge, because the DAX will keep on rallying.

DAX Future Evolution Based On German Economic Data by Razvan Mihai