| Manufacturing Sales m/m |

2.6% |

0.6% |

-0.6% |

|

| Foreign Securities Purchases |

-6.31B |

7.28B |

14.32B |

|

| Overnight Rate |

1.00% |

1.00% |

1.00% |

|

| Core CPI m/m |

0.2% |

0.2% |

0.8% |

|

| CPI m/m |

0.2% |

0.3% |

1.2% |

|

| Wholesale Sales m/m |

0.0% |

0.4% |

0.5% |

Last week we have seen an increase in the Manufacturing Sales but drops in the CPI and Wholesale Sales. The loonie has suffered also from the fell in the commodities prices. The currency fell the most since 2011 as commodities slid, led by gold but also the drop in the price of WTI Crude oil. Bank of Canada maintained the interest rate at 1% but cut the growth forecast for this year at 1.5%.

For next week it is expected a drop in the Retail Sales from 1% to 0.3%.

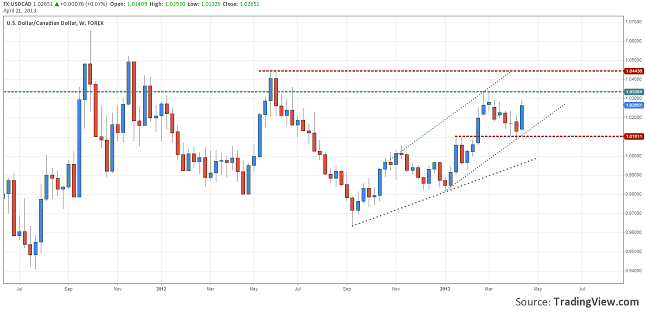

On the chart we can see that the price was rejected from a key support level at 1.0100. This week we might see a retest on the high of the last 10 months, or maybe a breakout which will open the way for 1.0440.

Wrap UP 15-19 April USDCAD Up 1.23% by Razvan Mihai