Japan

| Economic Indicator | Actual | Forecast | Previous |

| CSPI y/y | 0.1% | 0.0% | -0.2% |

| Retail Sales | -2.3% | 0.9% | -1.1% |

| Household Spending y/y | 0.8% | 0.4% | 2.4% |

| Tokyo Core CPI y/y | -0.5% | -0.6% | -0.6% |

| Unemployment Rate | 4.3% | 4.2% | 4.2% |

| Prelim Industrial Production m/m | -0.1% | 2.6% | 0.3% |

| Housing Starts y/y | 3.0% | -1.0% | 5.0% |

Last week was not a spectacular one for Japan’s economy. Tokyo Core CPI came as a good news, after its value was published -0.5%, meaning that the yen depreciation had an effect. Kuroda spoke before the Diet, in Tokyo. He said nothing, though, regarding the new monetary policy that will be adopted to help end 20 years of def. He said nothing, though, regarding the new monetary policy that will be adopted to help end 20 years of deflation.

In the first part of next week Tankan Manufacturing and Non-Manufacturing Index and Average Cash Earning will be published. In the second part the volatility might rise substantially on the Monetary Policy, Overnight Call Rate and BOJ Press Conference.

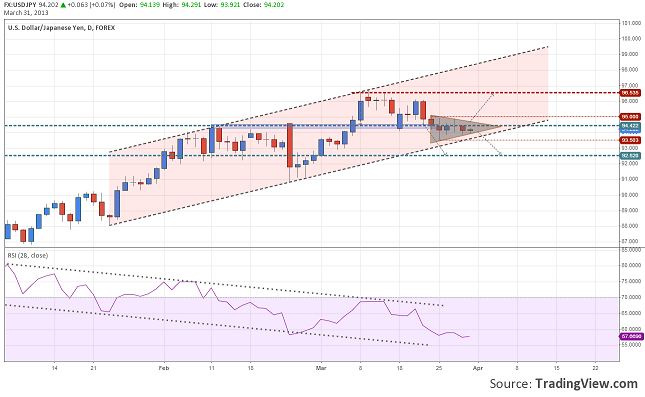

At this point the cart of USDJPY shows a big indecision zone. The price consolidated between 93.50 and 95.00 and over the uptrend line. Depending on the market reaction after the monetary policy statement we might see a breakout over 95 yens per dollar and a rally to 96.53 or a drop under 93.50 all the way to 92.50.

Wrap Up 24-29 March USDJPY Down 0.3% by Razvan Mihai