Tomorrow is the much awaited day, when chairman Ben Bernanke will expose his decision concerning the evolution of the third Quantitative Easing program that has been implemented for one year, so far. Everybody’s eyes will be on Fed’s chairman and for sure the markets will be highly sensitive to each word delivered.

The big question is: will the QE3 be reduced now? Or later this year?

Most of the investors, and also most of the surveys conducted by Reuters and Bloomberg are pointing towards a contraction of $10 billion that will be announced tomorrow, but the amount may vary between $5 and $25 billion. Tomorrow are expected forecasts about the American economy for 2016 and it will be interested to follow the way they will treat the fact that in January 2014 Ben Bernanke will no longer lead the Federal Banks of the United States. Janet Yellen is the favorite so far, but we have to be careful to any possible surprises.

Even if economists believe that Yellen’s approach will be almost the same as the one of Bernanke and another chairman will make radical changes, we cannot expect this scenario to happen. Giving the size and importance of the QE, no matter the chairman, decisions will be taken in the best interest of the American economy. Thus, tapering will happen gradually and further changes will be made according to data coming from the labor and housing sectors, in particular. Anyhow, the difficult part of the process of strengthening the economy just now is coming, and the next chairman will have to be able to control the situation in a proper way.

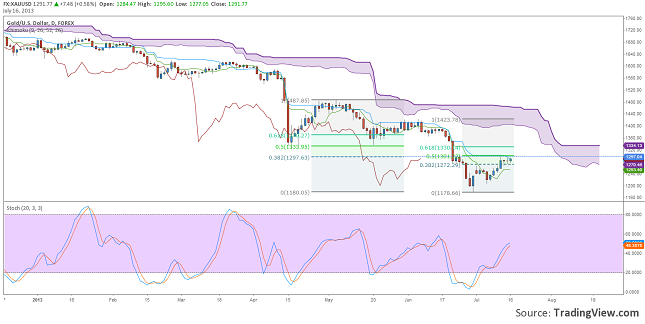

Both gold an silver’s futures dropped in anticipation of the decision that is coming tomorrow, investors preferring to wait. As it concerns the price of gold, it is expected to further decline until the end of this year. Same for the emerging markets, which are already feeling the effects of the “absence of QE” due to the considerable decrease of inflows of money.

Connect With Us