Last week the FOMC statement showed that Federal Reserve officials are still on the Quantitative Easing side. It seems that the QE is expected to be shut down only if the unemployment rate will drop to 6.5% or if the inflation rate will rise 0.5% above the medium target. Keeping in mind that the United States has an unemployment rate at 7.4% we can say that it might take a while until the end of the program or at least until the tapering. On Thursday the unemployment claims surprised with a value of 326K (under estimates) while on Friday the Non-Farm Payrolls came at 162K, with 20K lower than the forecast.

On Thursday the ECB maintained the interest rate a record low 0.50%. The main ideas from Draghi’s press conference were: the ECB will continue to keep low interest rates and high liquidity, will keep the door open for new rate cuts and forecast a slow recovery at the end of the year and in 2014.

The latest economic releases for the Euro Area were mainly above expectations: a lower unemployment rate, higher PMIs for both manufacturing and services sectors and better industrial production for Germany.

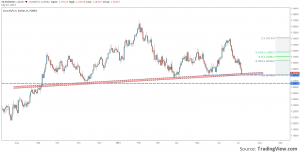

Chart: EURUSD, Weekly

Looking at the EURUSD we can see that the pressure is now on the upper line of a symmetrical triangle. Last week was a Doji candle above 1.3200. If this week will close above 1.3345, last week’s high we might see a rally toward 1.34 or why not even higher to 1.35. A false breakout above 1.34 could signal a reversal.