Last week was pretty intense and seemed like a roller coaster of emotions for the markets. The week started with the escalation of the Crimean conflict and USDJPY had a slide just to soar for the reminder of the week after Vladimir Putin declared that there is no immediate need to invade the Ukraine. As a result, safe haven assets took a blow and the US dollar gained, managing to break the 103 level and to send the USDJPY quotation to 103.20.

Besides the geopolitical conflict form the Ukraine, the macroeconomic data favored the US economy as last week was poor in economic indicators for the Japanese economy, so the headline was the NFP indicator, which surprised the investors in a good way for the first time in the last three months. The improvement for the US labor market was signaled by the unemployment claims with a day before the NFP when the jobless claims were reported at a three month low.

Economic Calendar

Current Account (7:50 GMT)-Sunday. This indicator measures the difference in value between imported and exported goods, services, income flows and unilateral transfers during the reported month. It is a medium impact indicator, but you should pay attention to it because last month, the widest deficit on record for the Nippon economy was registered and for this month it is forecasted to widden even more.

Final GDP q/q (7:50 GMT)-Sunday. Basically, it measures the change in the inflation-adjusted value of all goods and services produced by the economy. It is very important as it is released quarterly and it is considered the broadest measure of economic health. The last two releases were below expectations, so it will be interesting to watch which will be the outcome this time.

[sociallocker]

Economy Watchers Sentiment (1:00 GMT)-Monday. It is a low impact indicator, but you should be careful in case it will produce a great surprise and some volatility. Also, it is derived via a survey of about 2000 workers which asks respondents to rate the relative level of current economic conditions.

BoJ Press Conference (Tentative)-Tuesday. It represents the primary methods the BoJ uses to communicate with investors regarding monetary policy. A more hawkish view than expected is good for the yen. Also, it is a high impact event, so investors will watch the speech of the BoJ Governor closely.

BSI Manufacturing Index (7:50 GMT)-Tuesday. It is a medium impact indicator that measures the level of diffusion based on the large manufacturers surveyed . Above 0.0 indicates optimism while below 0.0 indicates pessimism. It is a leading indicator of economic health, so you should be careful at the volatility it may produce.

Core Machinery Orders (7:50 GMT)-Wednesday. It is a leading indicator of production as rising purchase order signals that manufacturers will increase activity as they work to fill the orders. The value published last month was disappointing for the investors, so it will be an interesting indicator to watch as this month an increase of 7.3% is forecasted .

Technical View

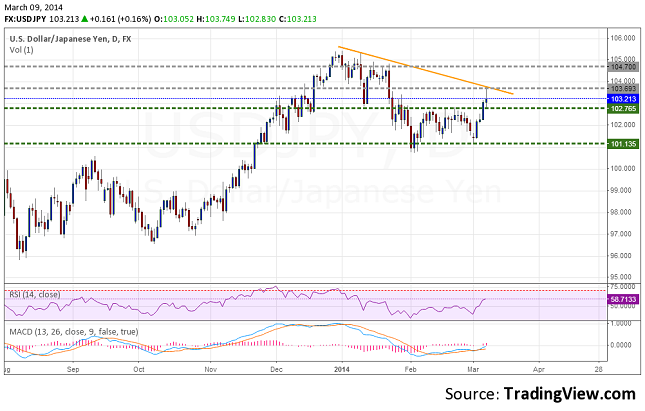

USDJPY, Daily

Support: 102.75, 101.15

Resistance: 103.70, 104.70

The daily chart shows us how the US dollar was practically unstoppable in front of yen last week and it has drawn the beginning of a descending trend. The MACD Histogram indicates that the upwards movement is still in charge and the RSI tells us that the price still has a lot until it will enter in the overbought zone, so I will go with a consolidation for this week with moderate chances of hitting the 104 level if the geopolitical situation remains calm.

USDJPY, H1

Support: 102.75, 102.30

Resistance: 103.70, 104.15

The hourly chart best depicts the ascending rout USDJPY had last week while the MACD Histogram points toward a slowdown, a tiredness of the bulls. So, the outlook remains bullish on a shorter time frame as well, but with a grain of salt. The resistance line from 103.70 is to be watched as a breakout above this level could be a strong bullish signal.

Bullish or Bearish

Overall, to give an absolute direction is kind of hard as the geopolitical turmoil can turn the markets upside down in any moment. This is why this week I will go with a moderately bullish outlook for the USDJPY, moderately meaning that I pledge for caution this week more than previous weeks. If the Crimean conflict gets resolved, we could have a rally from the US dollar, but carefulness remains the word of the week.

[/sociallocker]

USD/JPY Forecast March 10-14 by Alin Rauta