The bulls had the upper hand last week and managed to push higher the NZDUSD quotation, gaining almost 100 pips. The indicators for the New Zeeland economy really helped this time and posted a better than expected trade balance surplus (306 million NZD). The ANZ Business Confidence continued the pleasant surprises with an improvement from 64.1 to 70.8 levels. Also, at the beginning of the week the data from the US were still weak, giving NZDUSD a solid advance.

Economic Calendar

ADP Non-Farm Employment Change (8:15 GTM)-Wednesday. This data provides an early look at employment growth, usually two days ahead of NFP, for the labor market from the United States.

Non-Farm Payrolls (8:30 GTM)-Friday. It measures the change in the number of employed people during the previous month, excluding the farming industry. This is a vital economic indicator as job creation is the major target of the Federal Reserve.

Taking into account that this week we won’t have any macroeconomic data from New Zeeland, the indicators which will have the greatest impact are the ADP report and the NFP from the US labor market.

Technical view

NZDUSD, Daily

Support: 0.8240, 0.8050

Resistance:

[sociallocker]

The technical signals are pointing towards a descending path for NZDUSD this week as a bearish candlestick pattern called Shooting Star emerged after the price previously hit the local high from 0.8428. The 100 Exponential Moving Average could draw the price downward to the support line at 0.8240 and a close below this level could even amplify the descending trend further to the local low from 0.8050.

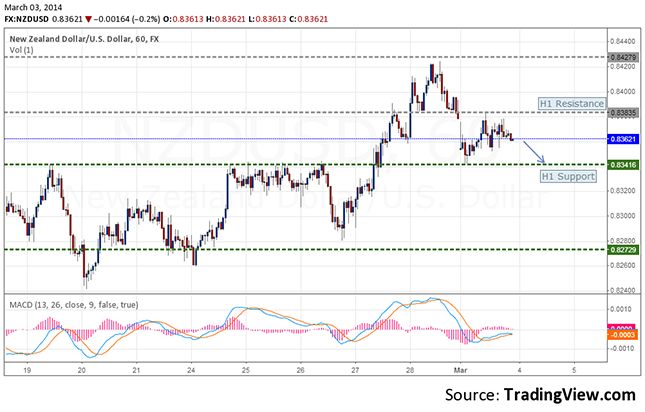

NZDUSD, H1

Support: 0.8340, 0.8280

Resistance: 0.8383, 0.8428

On the hourly chart I see a sideways movement between the H1 Support and Resistance before a breakout confirmed by a close below the support line could occur and giving the price action a descending trend. The MACD shows us that sellers are becoming stronger, so it will be interesting if the H1 chart confirms the bearish trend we have seen on the daily chart.

Bullish or bearish

Besides the technical view that is giving me bearish signals, I think the fundamental part is in correlation as we should be very careful to some extreme market movements because of the conflict escalation between Ukraine and Russia. In this type of situations, the US dollar gains in front of minor currencies as NZD, so I think the NZDUSD will have a pretty bearish week.

[/sociallocker]

NZD/USD Forecast March 3-7 by Investazor