NZDUSD had a good week, winning 120 pips after the American economy gives some tiredness signals. New Zeeland macro indicators were mixed with the REINZ HPI being reported weaker than last month’s (-2.4% vs. -1.0%) and the FPI which increased by 1.2% after last month came in negative territory. The Chinese economy helped the kiwi to advance in front of the US dollar with a trade balance way better than the market expectations. NZDUSD closed the week at 0.8369 hitting the best level in one month.

Economic Calendar

Retail Sales q/q (4:45 GTM)-Sunday. This indicator is of high importance as it is the primary figure of consumer spending and tends to create a powerful market impact. It is expected an increase of 1.7% for the last quarter.

PPI Input q/q (4:45 GTM)-Wednesday. It is a leading indicator of the consumer inflation as it measures the change in price of goods and raw materials purchased by manufacturers. It has a medium importance, but a surprise could trigger some action and we could have some volatility.

As you can see, this week is rather poor in economic indicators from New Zeeland, but do not forget about the American ones which always can create some surprise, especially now when the stock markets are preparing for new all-time high and gold seemed to pick up.

Technical view

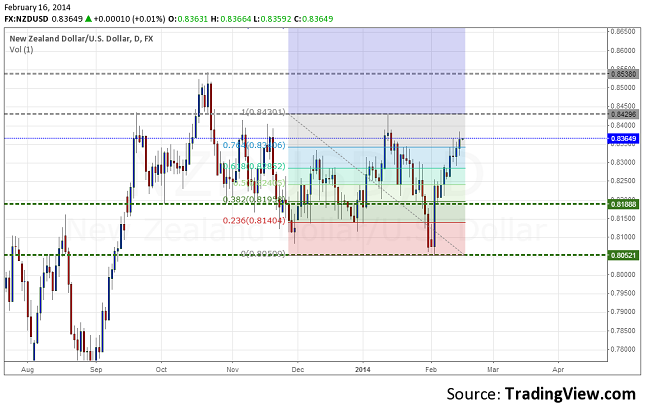

NZDUSD, Daily

Support: 0.8190, 0.8050

Resistance: 0.8430, 0.8540

The daily chart shows how NZDUSD surged for the last two weeks and closed above the 76.4 Fibonacci level, showing that the bulls are in charge. The next target for the kiwi would be the local high from 0.8430, level which is also a daily resistance. If we will see a strong number in the retail sales, NZDUSD could easily break the 0.8430 level and go after the next resistance at 0.8540.

NZDUSD, H1

Support: 0.8300, 0.8190

Resistance: 0.83900, 0.8430

On the H1 timeframe, NZDUSD drew a consistent uptrend, but with high chances of a reversal if the rising wedge gets confirmed. A downward movement to H1 support at 0.8300 will be the validation of the reversal pattern whereas a breakout above the H1 resistance will invalidate the descending hypothesis and would send the kiwi towards the resistance at 0.8430.

Bullish or Bearish

The daily and hourly charts seem to me kind of mixed, so I think that NZDUSD will have a zigzag type of movement for the next week. On intraday term I see it slightly bearish, so I would not be surprised to have a week in which the bears to come back in charge and to send the NZDUSD towards 0.8300.

NZD/USD Forecast February 17 - 21 by Alin Rauta