The gaps that appear on a chart are pretty important. It is a price pattern which can offer information regarding the direction of the price and the strength of the market. On Forex, because of the high liquidity, gaps are not that frequent, but they do appear especially after the weekends.

In trading a myth, that the gaps are always covered, was born. The gaps are usually covered, but it can be done very fast or it can take a longer time until it will be covered.

It is important to know that there are mainly four types of gaps:

- Common gaps, which usually appear inside a price pattern and they are easily covered (Head and Shoulders, Rectangle, Triangle, etc.).

- Breakaway gaps, these gaps appear when the price breaks from a price pattern or above/under important levels and shows that the market is ready to continue the move and they are not that easy to be covered.

- Runaway gaps, these are continuation patterns just like Flags and Pennants and are they are very hard to cover because of the strength and determination of the market to move forward.

- Exhaustion gaps are announcing that the market has reached a limit and the current move might be reversed soon and this is why it is easier for this gap to be covered.

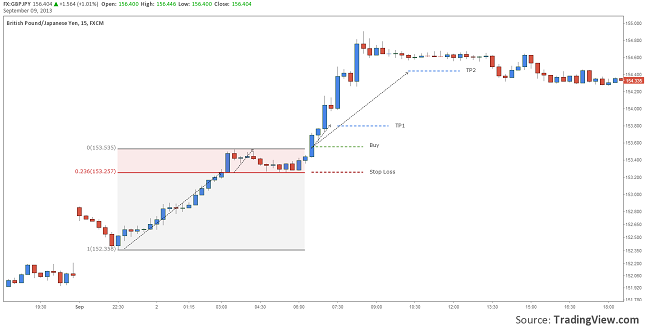

The strategy we recommend when trading gaps it is pretty easy. When a gap appears a trader should look for other technical elements that will tell him what kind of gap it is. If he managed to determine if it is a common, breakaway, runaway or exhaustion gap, then he should wait for another candle to be drawn.

An opening of a trade right at the opening of the gap it is pretty dangerous. If another candle or candles are drawn he can use the new low as a support level. A break through this level can be used as a trigger for the trade. The Stop level can be set above a high; it can also be the closest one. As take profit the trader can set several levels. One can be the 50% of the gap and the second the high of the last candle before the gap.

See our example on the next chart:

Chart: EURUSD, M5

This system can be adapted for all Forex instruments and time frame. The trader should consider other elements like support/resistance for his stop loss and take profit levels. The gaps could be fully closed or just partial and that is why it would be better to take into consideration several TP levels. Do not forget to apply to this strategy also your money management.