The oil industry, as one of the most important industries, is mainly driven by North America, Russia and the Arabic States (most important countries being Saudi Arabia and Iraq). Why is this industry so important? Considering the fact that is responsible for about 2.5% of the world’s GDP, it’s also pumping life in all other important fields as transportation, agriculture, army and any other branch that supports the human life. If the oil industry would collapse now, it wouldn’t take a few months to see the world’s economy on the ground. Nowadays, the supply of energy tends to increase because of the continuous increase in demand, which results in the development of the economies in question (reflected by their GDPs).

Meanwhile, North America is seriously gaining ground in the oil industry, threatening to become the biggest oil producer by 2030, as last year recorded the world’s biggest increase in oil and gas production (80% of which came from North Dakota and Texas). It is also likely to become self-sufficient around 2020 as the production will increase and the demand will fall, due to the efficient use of resources. The “power shift” will probably happen in the near future and the dominator is likely to be the United States which will for sure cause an energy boom by its drilling technology that can reveal important quantities of oil. This situation is thought to cause the defeat of the OPEC states which will be required to accept new regulations and will have diminished their power of making the market (as a secondary effect it is believed that the Arabic nuclear programs will lose momentum). Obviously, the U.S.’s economy will benefit from this power shift, leaving behind the quantitative easing programs.

In the area of the Arab States, where important oil producers are found, we encounter significant turbulences. The internal conflict between Iraq and Kurdistan, a semi-autonomous zone within Iraq, poses problems to the production of oil, as Kurdistan and Iraq have an interdependent infrastructure. The two countries are also fighting about the rights upon the oil reserves and the benefits resulting from exploiting those resources. As a general view over the Arabic’s oil production, things are likely to go in a negative direction, as conflicts between countries are worsening and the lack of technology may result in an ineffective business (leading to higher costs of production).

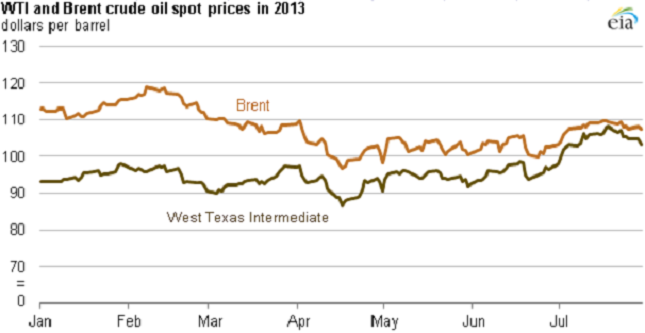

Recently, the narrowing between benchmark prices of Brent and WTI crude oil got in the viewfinder. The price of WTI crude oil is thought to have been increased due to several factors as the projects for the oil transportation which came online, making it available in new areas, fact that lead to an increase in demand. On the other hand, the narrowing of prices also derives from the downward pressure on the Brent oil caused by the access to domestic light sweet oil which can easily replace the imported Brent oil.

Chart: WTI and brent crude oil spot prices in 2013

The outlook for the next year concerning the oil market awaits some improvements as economic growth in 2014 is expected to reach 3.5%. Non-OECD countries are projected to continue to lead the oil demand growth, while OECD economies are expected to remain in decline mode.

Who Is The Next Leader Of The Oil Industry? by Silvia Gabor