China is known as one of the emerging countries (next to South Korea, Singapore, Taiwan and Hong Kong) whit an amazing rhythm of growth (7-8% increase of the GDP), currently having the position of the second largest economy in the world and seriously threatening to take the first place in this rank (currently held by the United States). China was not always the economic power it is today. This meteoric rise started in 1978 along, with Deng Xiaoping’s reform program.

A look in the past…

By the mid 70’ China was a wreck. The “cultural revolution” initiated and led by Mao Zedong took China down the wrong path. The majority of the country’s economic production was controlled by the state and as a result, by 1978 nearly ¾ of the industrial production was produced by state-owned enterprises (SOEs), according to centrally planned output targets.

The Chinese economy was in a relatively stagnant and inefficient state, mainly because of the centrally planned economy policies which gave few profit incentives for firms, workers, and farmers. Additionally, competition was virtually nonexistent, foreign trade and investment flows were mainly limited to Soviet bloc countries, and price and production controls caused widespread distortions in the economy.

Life after the reforms

Deng Xiaoping, the architect of China’s economic reforms, was the first to acknowledge the fact that his country desperately needed reform, portraying the whole situation by the following words: “Black cat, white cat, what does it matter what color the cat is as long as it catches mice?”

Besides articulating the Four Cardinal Principles, he was the first to propose and insist that China undertake reform, adopt an open policy and invigorate the economy. The four cardinal principles actually marked the entry in a new era for the Chinese socialism. The implications of the Four Cardinal Principles were huge because besides them everything could be questioned, from political ideas to economic measures. The reform strategy stated by Deng Xiaoping contained 3 big directions: economy, foreign affairs and internal policy.

Internal policy

He understood that in order to build a powerful and prosperous country, first, he would have to reunify China, which, in other words meant to resolve the questions of Taiwan, Hong Kong and Macao. Deng Xiaoping’s solution: “one country, two systems”. This concept helped a lot in the process of building the socialism of today’s China. After the internal political issue was solved, it was the time for the economic reform to take the lead.

Economy

Back then, 80 per cent of China’s population lived in the countryside; it was there that the reform was to begin. First step was to initiate price and ownership incentives for farmers in order to allow Chinese farmers to sell their production. The new agricultural policy, led by Deng Xiaoping led to a substantial boost in China’s agricultural output. Another important reform was the decision to allow local municipalities and townships to invest in their own industries. After the success in the countryside, Deng decided to take the reform to the next level, urban areas.

Because urban reform was more complicated than rural reform, Deng urged that some regions should be allowed to become prosperous, so that others would follow their example. The first step was to allow the private sector to develop properly, as a supplement to the socialist sector.

So, on his proposal, four special economic zones were established and 14 coastal cities were opened to the outside world with the purpose of attracting foreign investment, boosting exports, and importing high technology products into China. On the basis of mutual benefit, China would vigorously expand its economic cooperation with foreign countries, absorb their capital and introduce their advanced technologies, all of this in order to accelerate the development of its own economy.

Foreign policy

Deng Xiaoping was the one responsible for China’s independent foreign policy, which in essence consists of standing firmly on the side of the Third World countries, opposing to the western powers. In term of results this policy made China the biggest investor in areas such as Africa and South East Asia, regions well known for their abundance in mineral and energy resources which are ingredients of strategic importance in feeding a booming economy, such as that of China.

Results

Since the introduction of economic reforms, China’s economy has grown substantially fast, which is, China’s average annual real GDP has grown by nearly 10% .This means, on average, that China has been able to double the size of its economy in real terms every eight years.

However, the global economic slowdown, which began in 2008, came as a drag for the economy and China’s real GDP growth fell from 14.2% in 2007 to 9.6% in 2008 to 9.2% in 2009. The financial crisis prompted the Chinese government to implement a large economic stimulus package and an expansive monetary policy which eventually boosted domestic investment and consumption and most importantly helped prevent a sharp economic slowdown in China.

Nevertheless, in 2010 China’s real GDP returned above the 10% benchmark and grew by 10.4% while in 2011 got back to the 2009 value and it rose by 9.2%. Taking into account this statistics, China has been able to maintain steady economic growth rates, especially compared to those of other major economies. In 2012, China’s real GDP growth slowed to 7.8%. The International Monetary Fund (IMF) in July 2013 projected that China’s real GDP would grow 7.8% in 2013 and 7.7% in 2014 signaling that China’s economy may enter in a cooling period.

Third Chinese Plenum

On 15th of November 2013 a 60-point document was released by the Communist Party on reform pledges after leaders met to map out policy changes for the coming decade. To sum up, the much anticipated and recently completed Third Chinese Plenum upgraded the importance of markets in its philosophy from previous policy statements which often described markets as playing only a “basic” role in allocating resources, but it also made clear that it had no plans to radically reduce the role of the state in the economy. The target for achieving success with these reforms is 2020.

Taking the discussion to a more particular note, item 12 of that 60 point document focused on improving financial markets, including moving to a registration-based system for issuing stocks, Communist Party leaders pledging to change the system as part of a package of reforms to allow markets to play a “decisive” role in setting prices and allocating resources.

On 30th of November, two weeks after the Third Plenum and the reforms associated with it, China Securities Regulatory Commission hits the markets with an announcement. China’s securities regulator issued a reform plan for initial public offerings, as the government prepares to lift a more than one-year freeze on new listings in the world’s second-biggest economy and about 50 companies are expected to complete the IPO approval preparations and list or be ready to do so by the end of January. There are more than 760 companies in the queue for approval and it will take about a year to complete an audit of all the applications, it said.

This statement comes in the context in which, China, the world’s largest IPO market in 2010, with a record $71 billion raised, hasn’t had an initial public offering since October 2012 as the CSRC cracked down on fraud and misconduct among advisers and companies.

So, with an inefficient banking sector as it is in China, these series of IPOs could be a big step towards a revival and also could make for a good investment. I think the sector which may be between those with the highest growth next year is the financial one, especially the stock markets.

The reasoning would be the following. With so many IPOs next year, the banks will have its hands full, so the winners of this situation would be the Chinese banking giants. As Benjamin Graham would say, the IPO game is not a game for the intelligent investor because you can buy stocks of those new listed companies at a discounted price after the euphoria starts to fade and you can figure out which stocks really has growth prospects and which you can buy right after they hit bottom. Hence, the investors will follow which banks will be responsible for the large majority of the IPOs underwriting process and will buy their stocks because in this whole story the banking system is the main beneficiary.

Economic indicators

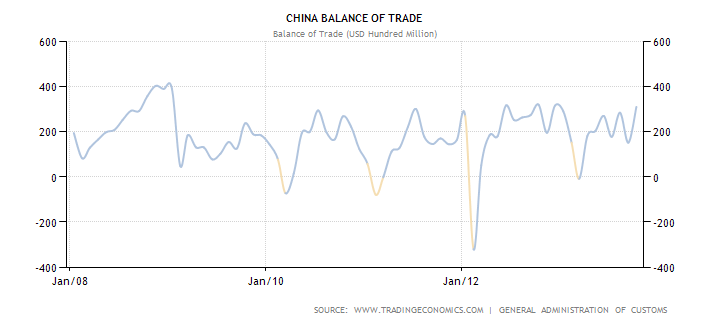

The Chinese trade balance increased in October to 31.1 billion USD as exports grew with 5.6%, stronger than expected. The exports were sustained by the increased of shipments to E.U. with 12.7% while those to the U.S. grew 8.1%. In the first 10 months of 2013, China’s total trade reached 3.4 trillion USD, up by 7.6 percent over a year earlier, but below the government’s target of 8 percent.

For the foreseeable future, economists are afraid that the weak evolution of the world’s economy will aggravate the process of China becoming the most powerful country in the world. China succeeded in becoming a significant and reliable exporter for economies like the United States (accounts for roughly 17% of China’s exports) and Europe (accounts for approximately 16% of China’s exports) but these economies are slowing too. Should the government be worried about the capacity of its domestic demand to absorb its domestic production capacity?

The same scenario is available for the evolution of the Gross Domestic Product as the possibility of missing its 7.5% target increased. If in the period 2003-2008 the yearly evolution of the GDP ranged between 15.7% and 22.9%, staring with 2009 since now, the GDP didn’t exceed 17.8%, last year being reported to 9.8% with lower expectations for 2013. The largest share in the calculation of the GDP is taken by the industry and manufacturing fields (of which the most prominent comprise of petrochemical, metallurgy, forestry, medicine, food and machinery). As the Chinese government doesn’t seem ready to accept a below target of the GDP, economists are expecting the Central Bank to intervene and take measures as: a cut in the interest rate and sustaining the yuan devaluation.

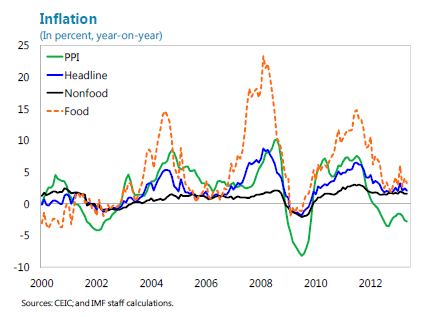

Inflation in China raised in October to 3.2%, with food prices rising the most. Premier Wen Jiabao believes that China is under inflationary pressure. Also, he sets the inflation target to 3.5% for 2013, lower with 0.5% than the target for the previous year as the price stability was always an important characteristic of the Chinese economy. As it concerns the final of the year, the inflation is believed to stay under reasonable levels. Given the fact that China is considering important reforms which are due to sustain the economic growth, inflation may fluctuate, exceeding the limits set.

Investing opportunities

China’s strongest point is the fact that it is a large consumer of labor force, keeping its economy in movement. By becoming the larger supplier of products like TVs, washing machines, air conditioning machines or microwaves, China is making itself indispensable to the world and is boosting its exports to incredible results.

Difficulties: an inefficient banking sector and a weak services sector.

Advantages: large market of human resources, cheap labor force, favorable market for investors, attractive territory for new businesses.

Since the beginning of the 21st century it was raised the issue of revaluation of the “people’s money” or renminbi. The parties that suggested this move wanted to see the national currency fluctuate free, thus the exchange rate will be influenced only by market forces. It was also targeted an appreciation of the currency which would arouse many reactions considering the fact that China is an important exporter for the world’s economies. China withstood in front of all these pressures.

It is interesting to observe the exporting characteristic of the Chinese territory, aspect that help China become the second economy in the world. Since China produces large amounts of products, on which many countries rely, China is also offering small production costs which are reflected in small prices. This situation forces other nations which have their GDP strongly influenced by exports to line up to certain rules like: buying chines sub assemblies in order to be able to produce cheaper products, moving the production process in China or searching other countries with cheap labor force, increasing the productivity based on automation. The exporting countries are forced to make such changes in order to survive to a competitor as China.

It is known that the main competitor of China is the United States. In the event that China will surpass the U.S. we could expect significant reactions concerning that the two economies are driven by different polices and regimes. Economies will question the democratic aspect together with the American system of laws which are now out passed by a communist regime, a country that doesn’t offer an adequate protection of intellectual property rights, with a regime of subsidies rigorously controlled. The rise of China is permanently questioning whether or not its politics and rules are more efficient that the European or American ones.

Challenges

American SMEs are very active in China. As American small to medium sized enterprises account for 99.7% of all U.S. companies, they are trying to expand their businesses to other relevant markets and China is one of the attractive markets. The AmCham Shanghai SME Center is designed to support and help American SMEs to get access on the Chinese market. Both China and the U.S. are very aware of the fact that strengthening the relationships between them, by developing the SMEs on the Chinese territory, implies eliminating trade barriers and generates economic growth. The most significant challenge on this matter is the regulatory environment. A survey, based on talking with the American SMEs activating on the Chinese territory, is reporting the fact that the regulatory system in China is very unclear and leads to additional costs and undue risks to their operations. The legal and regulatory system can be opaque, inconsistent, and often arbitrary.

One of the issues of the Chinese banking system is the lack of ability to allocate credit according to market principles, favoring the State Owned Enterprises (SOE). According to a study, in 2009, 85% of all bank loans ($1.4 trillion) were allocated to SOEs (most of these borrowings are believed to remain unpaid, resulting thus in a great number of nonperforming loans held by the banks).

Lack of effective protection of intellectual property rights is another serious problem as 44% of U.S. SMEs cited the lack of “protection and enforcement of your IPR” and almost one-third indicated concern for the theft of their company’s trade secrets. Another issues raised by more than two-thirds of SMEs were the unfair competition and the trouble in finding the right customers.

Another challenging aspect of the Chinese market is the heavy reliance on an export-led growth model. Parts of the Chinese bureaucracy still seek to protect local firms, especially state-owned enterprises, from imports, while encouraging exports.

As a strong characteristic of the Chinese economy is the fact that it is a planned economy (with five-year plans setting economic goals, strategies, and targets) we can extract from here the challenging aspect by analyzing a few issues. First of all, a planned economy leads to an unprofitable allocation of resources considering the lack of the law of supply and demand. Also, in such an environment, the economic decisions depend on the government or state rather than on the interaction between consumers and businesses.

These issues of the Chinese economy pose serious problems in developing many sectors of the country and in aligning to the world’s economic standards.

China Investing Opportunities for 2014 - Pros and Cons by Razvan Mihai