USDJPY had a flying evolution for the first four days of the week and managed to establish a two month high above 104.00 level. Friday was the day the investors were waiting for because the NFP report had to be published. The new jobs created were more than the last month, but below the expectations, so the US dollar was hurt and USDJPY fell, closing the week at 103.24.

The Japanese yen suffered losses last week because the macroeconomic data were pretty disappointing. The Manufacturing PMI came lower than last month with a 53.9 reading. The industrial production was published with a reduction of -2.3% whereas the forecasted value was an increase of 3.6%. The Housing Starts fell from +12.3% in February to just +1% for March. In the meantime, the American economy seems to recover from the sluggish start it had at the beginning of the year while the stock markets are at new all-time highs.

Economic Calendar

Leading Indicators (06:00 GMT)-Monday. This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously. Last month published above expectations with a value of 113.1% and for this week is estimated a value of 114.2%.

Current Account (0:50 GMT)-Tuesday. This indicator measures the difference in value between imported and exported goods, services, income flows and unilateral transfers during the reported month. It has a medium impact on the markets, so it will be very interesting to watch it closely as the current deficit is at all-time highs. For this month is estimated a deficit of -0.04T whereas last month we had a deficit of -0.59T.

Monetary Policy Statement & BoJ Press Conference (Tentative)-Tuesday. These two monthly events have a high impact on the markets because it is among the primary tools the BoJ uses to communicate with investors about monetary policy and the Press Conference always brings some serious volatility. It is written Tentative because it was not established yet the exact hour, which will be communicated Monday.

Economy Watchers Sentiment (06:00 GMT)-Tuesday. It is an index based on surveyed workers who directly observe consumer spending by virtue of their job. Above 50.0 indicates optimism, below indicates pessimism. For March it is expected an improvement as the forecasted value is 54.1, so pay attention to it as for the last two months it came below expectations.

Core Machinery Orders m/m (0:50 GMT)-Thursday. This is an important indicator for the Japanese economy as it represents the change in the total value of new private-sector purchase orders placed with manufacturers for machines, excluding ships and utilities. It is a leading indicator of production and for April it is expected to decrease with -3.2% which would create a big difference as in March was published an increase of 13.4%, so it has big chances to create some volatility.

Technical View

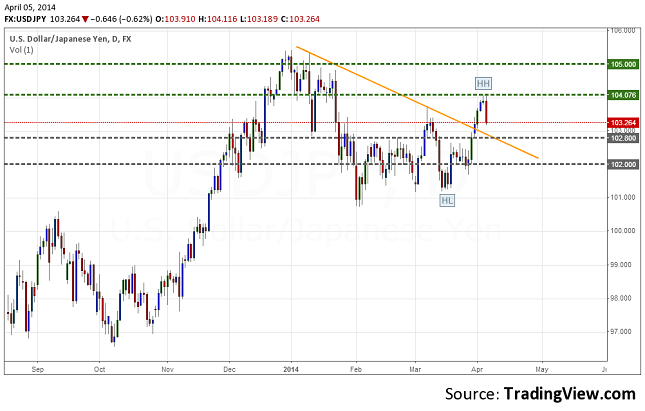

USDJPY, Daily

Support: 102.80, 102.00

Resistance: 104.00, 105.00

Last week we were talking about a descending trend that seems to take some shape, but the price seems to have other opinion. Monday, the quotation managed to break the descending trend line and closed the day above it. Then, the price continued the ascending path and scored a higher high after a couple of weeks ago it made a higher low. So, on the daily chart we have to see if the price will reject from the descending trend line and it will move further for a new higher high above 104.00.

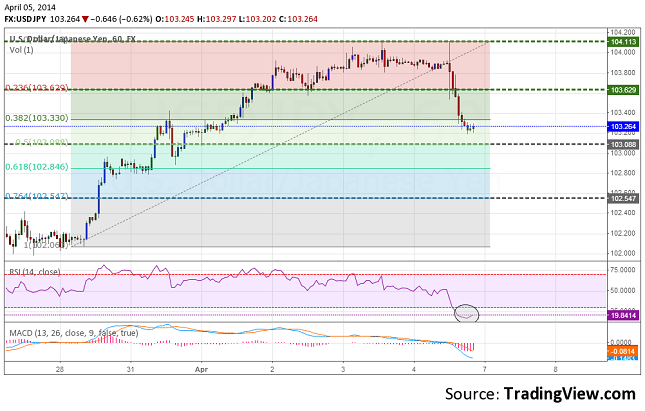

USDJPY, H1

Support: 103.00, 102.55

Resistance: 103.60, 104.10\

On the hourly I drew a Fibonacci retracement on the ascending impulse after Friday the US dollar fell. The quotation stopped around the 50.0 Fibonacci level which means the bears were really strong. Also, the RSI on 14 periods is on the oversold zone while the MACD Histogram gives some recovery signals as the power of the bears is getting weaker. So, on this timeframe I expect to see a retest of the resistance line from 23.6 Fibonacci level and the bulls to regain the control.

Bullish or Bearish

Overall, there are high chances to see a moderately ascending path for the USDJPY next week as the American economy fundamentals seems to be viewed as bullish from the investors’ side while the Japanese economy is having right now a slowdown. The most important event of this week is the BoJ Press Conference, so I think the speech governor Kuroda is going to deliver Tuesday can give the price a direction.

USD/JPY Forecast For April 7 - 11 by Alin Rauta