This is an update on our analysis DAX Future Evolution Based On German Economic Data.

The world economy has deteriorated during the past weeks, especially for Europe. Many of the macroeconomic indicators were published under market expectation, plus the problem with Cyprus triggered a risk aversion.

The confidence towards the bank sector has dropped rapidly on the conditions imposed by EU for a bailout to Cyprus. A deposit larger than 100.000 euros is now at risk, because in certain circumstances European Union, IMF and ECB could take the same actions for other countries in need for a loan.

Let’s leave aside for a moment the situation in Cyprus and take a look at the evolution of German economy. In our last analysis we observed that all the economic indicators published until 12th of March were surprisingly low. It will not surprise us now to see that even more of them were published under the market expectations.

| Economic Indicator | Actual | Forecast | Previous |

| Zew Economic Sentiment | 48.5 | 47.9 | 48.2 |

| PPI m/m | -0.1% | 0.2% | 0.8% |

| 10-y Bond Auction | 1.36/1.6 | 1.66/1.2 | |

| Flash Manufacturing PMI | 43.9 | 44.4 | 43.9 |

| Flash Services PMI | 41.9 | 44.1 | 42.7 |

| IFO Business Climate | 106.7 | 107.8 | 107.4 |

| GFK Consumer Climate | 5.9 | 5.9 | 5.9 |

From this table we can see that only ZEW Economic Sentiment has beaten the estimates, and the rest were well under their forecast.

The yields for the German bonds dropped 30 points to 1.36 and bid to cover ratio gain 0.4. This means that investors are looking to place their capital in safer assets. This can be easily underlined by looking at the evolution of Gold and Japanese yen (see our analysis Gold – Safe Heavens are Being Bought).

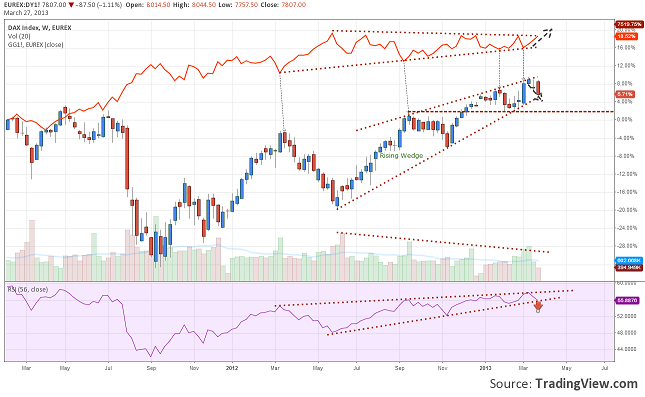

The reaction on the chart is pretty clear. The Bunds made a low in the same time with a high on Dax, just as expected. So we find ourselves again at a crossroad. The German average is now just over the lower line of a Rising Wedge, while the Bund’s price has reached the upper line of the symmetrical triangle. A breakout is quite possible in this agitated market. If this happens, our target for DAX is 7570-7600 zone.

DAX Is Down Bunds Are Up On Low Economic Data by Razvan Mihai