A really important week has passed for the EURUSD currency pair. As we know, in the first week of the month the ECB has the monetary statement and the press conference and the Non-Farm Payrolls is published for the United States.

At this press conference Mario Draghi pointed some things regarding the positioning of the ECB in what concerns the economy of the Euro Zone:

- Euro Area growth risks remain on the downside

- Inflation risks are broadly balanced, inflation rates may be volatile throughout the year

- Economy should recover at subdued pace

- 0.50% interest rate was maintained, but it is not the lower bound

- The rates to stay low for extended period of time

- ECB keeps an open mind on negative deposit rates

If this wasn’t enough, S&P lowered Portugal’s outlook to negative from stable. The country’s current grade is BB and rating company sees one in three chance of ratings cut within the next 12 months, and the also see a deficit about 5.8% of the GDP for 2013.

For the United States the story is a bit different. Several weeks ago Ben Bernanke said that the Federal Reserve is preparing for tapering the Quantitative Easing Program by the end of 2013, and stop it in 2014. The conditions for these measures were that the economy to head towards their forecast and the unemployment rate to drop to or under 7%.

One day after the ECB’s press conference, the Non-Farm Payrolls was published. It surprised the market with a value of 195K vs. 165K expected, and the previous value revised to 195K. Even though the Unemployment Rate did not come as expected and stagnated at 7.6%, the biggest impact came from the NFP.

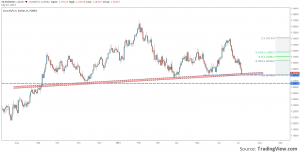

Chart: EURUSD, Daily

This week Euro dropped almost 1.5%. The biggest fall took place on Thursday and Friday. The speech of Mario Draghi did not encourage the investors to buy euros and the dollar continued its trend. Next day, the economic data showed an improvement in the US labor market, the dollar continued to appreciate.

From the technical point of view EURUSD got to a good support area, formed by 1.28 level and a trend line. The probability for the down trend to continue it is quite high. If this area will fall the next good support it is at 1.2650. Before a breakout we could see a bounce back to 1.29 or somewhere near 1.30.