On Tuesday, the United States told its citizens in Yemen to immediately leave the country. The official announcement on the U.S. State Department was: “The Department urges U.S. Citizens to defer travel to Yemen and those U.S. Citizens currently living in Yemen to depart immediately.”

On Tuesday, the United States told its citizens in Yemen to immediately leave the country. The official announcement on the U.S. State Department was: “The Department urges U.S. Citizens to defer travel to Yemen and those U.S. Citizens currently living in Yemen to depart immediately.”

Moreover, it seems that all diplomatic missions of the United States across the Middle East are to be closed these days, following warnings of potential attacks coming from the zone. Important communication between bin Laden’s successors as al Qaeda leader, Ayman al-Zawahri, and the Yemen based wing were intercepted by U.S. Secret Services. It is strongly believed that the terrorist attacks are oriented against the U.S. because of some drone aircraft strikes that took place lately in Yemen.

Even if Yemen is one of the poorest Arab country, the intensity of the threat must not be neglected, and measures already appeared in the whole Western countries. Great Britain also took initiative by advised its citizens in Yemen to “leave now” and by “temporarily evacuating all its embassy staff” (according to Reuters).

Given this context, it is important to analyze how the events can influence, on a short term period, the economic relations between Yemen and the United States. As we mentioned before, Yemen is not a rich country, but it has established diplomatic relations with the U.S. in 1947. It is not competing with other Arabic countries from the economic point of view, nor from the natural resources aspect.

Its oil reserves and natural gas deposits, on which the Yemeni economy is totally dependent, are important in the agreements between the two countries. However, the oil reserves in Yemen are expected to be depleted by 2017, possibly bringing on economic collapse. At this point, we can now argue whether these reserves are enough for the U.S. to keeping wanting the country close in a diplomatic manner.

The rupture announced these days does not seem so big as to have effects on the oil’s price on the international market. However, the announcement made by the U.S. about the closure of all diplomatic relations across the Middle East could raise questions and produce signals in financial markets. It is a situation to be closely followed, because consequences on short periods of time can appear and can also give birth to long term consequences on the financial markets, as the politics are strongly related to economics all over the world.

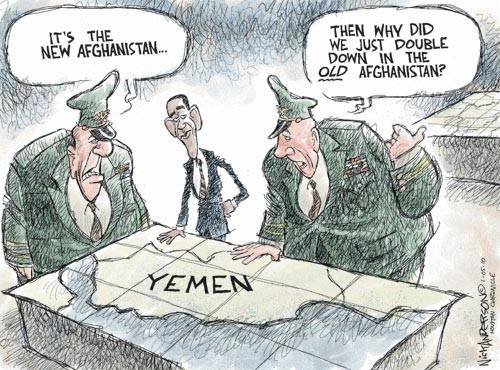

Depending on the consequences of these threats, which may prove false or true, we will be able to provide the economical consequences, at least in terms of oil prices. Of course, the position of the U.S. to these events is not negligible, but we might take into account that a total and irreversible retreat of them from Yemen is not possible, because of strategic reasons on which the United States are counting.