After six consecutive weeks, the US dollar managed to win the weekly battle in front of the EUR and pushed the quotation below 1.3800. The US dollar received some help from the weak European macroeconomic data and the speech Janet Yellen gave at the FOMC meeting. CPI y/y fell short of the expectations with a reading of 0.7%. The German ZEW Economic Sentiment disappointed with a value of 46.6 while the forecast was 52.8.

The newly crowned FED Chairman, Janet Yellen, managed to surprise the audience and the markets with an unexpected answer to the question, how much “considerable time” means in terms of the length of time when the Federal Reserve will raise the interest rates after the tapering comes to an end. Her answer, “around six months”, induced some panic in the markets, which was beneficial for the US dollar and sent EURUSD to a low of 1.3748.

Economic Calendar

Monday

German Flash Manufacturing PMI (8:30 GTM). Last month this indicator came below the estimated value for the first time in the last five months, so it will be interesting to see if the German manufacturing sector can surprise on the upside. This indicator it is a leading one for economic health and a reading above 50.0 indicates industry expansion.

Flash Manufacturing PMI (1:45 GTM). This indicator that measures the level of diffusion index based on surveyed purchasing managers in the manufacturing industry it is considered a medium impact indicator on the US markets. In February, the value was better than the expectations and for this month it is expected to come at 56.6.

Tuesday

[sociallocker]

German Ifo Business Climate (9:00 GTM). It is a leading indicator of economic health, this survey being highly respected due to its large sample size and historic correlation with German and wider Eurozone economic conditions. It tends to have a high impact on the markets upon release. In the last four months it was published above the forecasted value and you should keep an eye on this indicator as it has great potential to create some serious volatility.

Conference Board Consumer Confidence (14:00 GTM). It is a level of a composite index based on surveyed households. It has a high impact on the markets as financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity. It is expected to be published at 78.7.

New Home Sales (14:00 GTM). This indicator measures the annualized number of new single-family homes that were sold during the previous month. Also, it is a high impact indicator and a leading indicator of economic health. The forecasted value is 447K and any surprise could cause some serious volatility.

Wednesday

GfK German Consumer Climate (07:00 GTM). This indicator measures the level of a composite index based on surveyed consumers. It is important because financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity. This month the indicator is expected to stagnate at the value it had last month, so be alert in case a surprise happens.

Core Durable Goods Orders m/m (12:30 GTM). The production field had mixt readings in the recent months. This indicator is a high profile one because it is considered to be a leading indicator of production and measures the change in the total value of new purchases orders placed with manufacturers for durable goods, excluding transportation items. This month it appears that the analysts think the production slowed down and it is expected an increase of 0.3%.

Thursday

Unemployment Claims (12:30 GTM). This is one of the key indicators for the economic recovery of the US as the labor market is being attentive watched by the FED. It will be interesting to see if the American economy can make another positive surprise as in the last three weeks the jobless claims were below expectations.

Pending Home Sales (14:00 GTM). In the last five months, it was published below expectations and this month it is forecasted a value of 0.2%, so you should pay attention to it. This indicator is very important for the real estate sector as it measures the change in the number of homes under contract to be sold, but still awaiting the closing transaction.

Friday

German Preliminary CPI m/m (all day). This indicator it usually has a medium impact and it represents the change in the price of goods and services purchased by consumers. With an expected value of 0.4%, it will be interesting to see if this indicator can beat the estimated value for the first time in the last four months.

Technical Overview

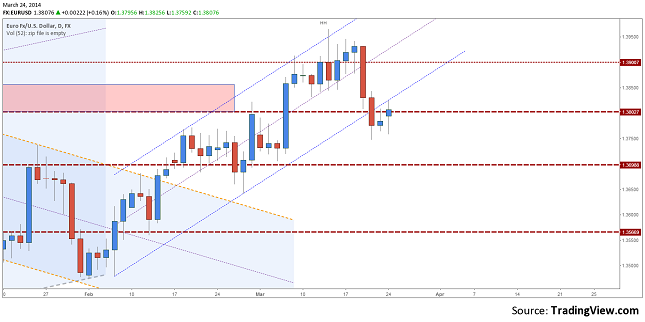

EURUSD, Daily

Support: 1.3700, 1.3600, 1.3570;

Resistance: 1.3900, 1.4000;

On a daily chart it can be seen that the price has fallen below the trend support line. This is a bearish signal for the medium term. For the moment the broken trend line was retested, another drop below the current lows would confirm the down move. As next support levels for a fall we can use 1.3700 and 1.3566. A positive signal would occur if the price will break above 1.3850.

EURUSD, H1

Support: 1.3800, 1.3764, 1.3750;

Resistance: 1.3822, 1.3870, 1.3915;

On a shorter time interval the EURUSD has consolidated itself in rectangle pattern. If the price will break above 1.3822 we could actually say that a Double Bottom pattern was drawn and the price action signals a positive move. If the price will break under the local demand area from 1.3750 to 1.3764 I am expecting a continuation of the down trend all the way to 1.3700.

Bullish Or Bearish

On medium term I am now bullish on the US dollar. There are a lot of fundamental and technical signals that shows bears have the power on the EURUSD. On a shorter time frame I would not be surprised to see another rally before continuing the down trend.

[/sociallocker]

Latest EURUSD posts:

EUR/USD Price Action For March 24;

EUR/USD Price Action For March 21;

EUR/USD Price Action For March 20;

EUR/USD Price Action For March 19;

EUR/USD Forecast March 24 – 28 by Razvan Mihai